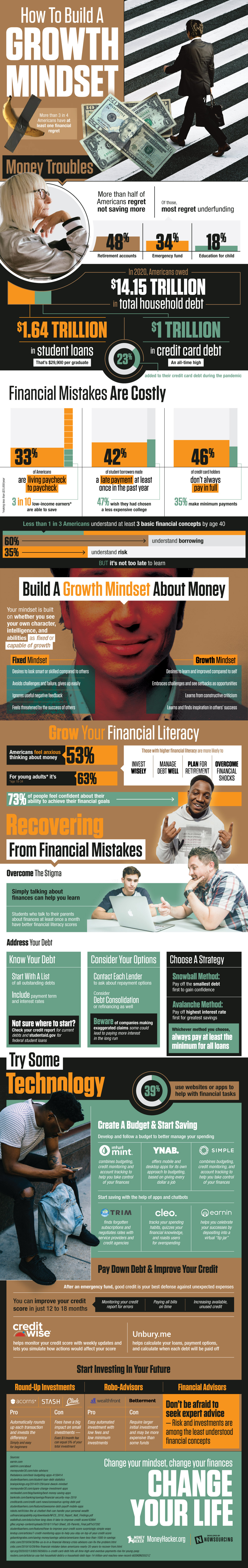

Maximize Your Money With A Growth Mindset

More than 3 in 4 Americans have at least one financial regret

Money Troubles

- More than half of Americans regret not saving more

- Of those, most regret underfunding

- Retirement accounts: 48%

- Emergency fund: 34%

- Education for child: 18%

- Of those, most regret underfunding

- In 2020, Americans owed $14.15 trillion in total household debt

- $1.64 trillion in student loans — That’s $29,900 per graduate

- $1 trillion in credit card debt — An all-time high

23% added to their credit card debt during the pandemic

- Financial Mistakes Are Costly

- 33% of Americans are living paycheck to paycheck

- Less than 3 in 10 low-income earners* are able to save (*making less than $25,000/year)

- 42% of student borrowers made a late payment at least once in the past year

- 47% wish they had chosen a less expensive college

- 46% of credit card holders don’t always pay in full

- 35% make minimum payments

- 33% of Americans are living paycheck to paycheck

Less than 1 in 3 Americans understand at least 3 basic financial concepts by age 40

- 60% understand borrowing

- Just 35% understand risk

- BUT that doesn’t mean it’s too late to learn

Build A Growth Mindset About Money

- What Is A Growth Mindset?

Your mindset is built on whether you see your own character, intelligence, and abilities as fixed or capable of growth

- Fixed Mindset

- Desires to look smart or skilled compared to others

- Avoids challenges and failure, gives up easily

- Ignores useful negative feedback

- Feels threatened by the success of others

- Growth Mindset

- Desires to learn and improved compared to self

- Embraces challenges and see setbacks as opportunities

- Learns from constructive criticism

- Learns and finds inspiration in others’ success

- Grow Your Financial Literacy

53% of Americans feel anxious thinking about money — For young adults* it’s 63% (*age 18-34)

- Those with higher financial literacy are more likely to

- Invest wisely

- Manage debt well

- Plan for retirement

- Overcome financial shocks

73% of people feel confident about their ability to achieve their financial goals — You can too

Recovering From Financial Mistakes

- Overcome The Stigma

- Simply talking about finances can help you learn

- Students who talk to their parents about finances at least once a month have better financial literacy scores

- 44% of Americans would rather discuss death, religion, or politics than personal finance

- What’s stopping you from talking about money?

- Embarrassment

- Fear of conflict

- Social expectations

- What’s stopping you from talking about money?

- Simply talking about finances can help you learn

- Address Your Debt

- Know Your Debt

- Start with a list of all outstanding debts

- Include payment term and interest rates

- Know Your Debt

Not sure where to start? Check your credit report for current debts and studentaid.gov for federal student loans

- Consider Your Options

- Contact each lender to ask about repayment options

- Consider debt consolidation or refinancing as well

Beware of companies making exaggerated claims — some could lead to paying more interest in the long run

- Choose A Strategy

- Snowball Method: Pay off the smallest debt first to gain confidence

- Avalanche Method: Pay off highest interest rate first for greatest savings

Whichever method you choose, always pay at least the minimum for all loans

- Try Some Tech

39% use websites or apps to help with financial tasks

- Create A Budget & Start Saving:

- Develop and follow a budget to better manage your spending

- Mint combines budgeting, credit monitoring, and account tracking to help you take control of your finances

- YNAB offers mobile and desktop apps for its own approach to budgeting, based on giving every dollar a job

- Simple offers fee-free round-up savings, savings goals, and envelope-style budgeting for account holders

- Start saving with the help of apps and chatbots

- Trim finds forgotten subscriptions and negotiates rates with service providers and credit agencies

- Cleo tracks your spending habits, quizzing your financial knowledge, and roasts users for overspending

- Earnin helps you celebrate your successes by depositing into a virtual “tip jar”

- Develop and follow a budget to better manage your spending

- Pay Down Debt & Improve Your Credit

- After an emergency fund, good credit is your best defense against unexpected expenses

- You can improve your credit score in just 12 to 18 months

- Monitor your credit report for errors

- Paying all bills on time

- Increasing available, unused credit

- CreditWise helps monitor your credit score with weekly updates and lets you simulate how actions would affect your score

- Unbury.me helps calculate your loans, payment options, and calculate when each debt will be paid off

- Start Investing In Your Future

- Round-Up Investments: Acorns, Stash, Clink

- Pro: Automatically rounds up each transaction and invests the difference — Simply and easy for beginners

- Con: Fees have a big impact on small investments — Even $1/month fee can equal 5% of your total investment

- Robo-Advisors: Wealthfront, Betterment

- Pro: Easy automated investment with low fees and low minimum investments

- Con: Require larger initial investment and may be more expensive than some funds

- Financial Advisors: Don’t be afraid to seek expert advice — Risk and investments are among the least understood financial concepts

- Round-Up Investments: Acorns, Stash, Clink

Change your mindset. Change your finances. Change your life.

Sources:

https://www.bankrate.com/banking/savings/financial-security-may-2019/

https://studentloanhero.com/student-loan-debt-statistics/https://www.creditcards.com/credit-card-news/coronavirus-spring-debt-poll/

https://www.gobankingrates.com/saving-money/savings-advice/americans-have-less-than-1000-in-savings/

http://www.usfinancialcapability.org/downloads/NFCS_2018_Report_Natl_Findings.pdf

https://gflec.org/wp-content/uploads/2018/11/Fact-Sheet_US-Parents_Final.pdf?x37292

https://www.brainpickings.org/2014/01/29/carol-dweck-mindset/https://www.thebalance.com/best-budgeting-apps-4159414

https://www.nerdwallet.com/blog/banking/best-money-saving-apps/ https://robots.net/it/cleo-the-ai-chatbot-that-can-handle-your-personal-wealth/ https://studentloanhero.com/featured/how-to-improve-your-credit-score-surprisingly-simple-ways/https://wallethub.com/edu/cs/how-long-does-it-take-to-improve-credit-score/42894/

https://studentloanhero.com/featured/awesome-debt-payoff-mobile-apps/